Policy Goals

Summary

· Net Metering

· Consumer Choice Policies

· Continued Expansion of EV and Green Hydrogen Transportation Infrastructure

· Expansion of Residential and Commercial Solar + Storage Capacity

· Solar for All

· Municipal and Solar for Schools Expansion

· Transmission Resiliency and Grid Strengthening

· Continued Expansion of Power Purchase Agreements

· Municipal Utility and Mid-Scale Project Value Expansion

· Expansion of Green Hydrogen Ecosystem Development

· Non-Commercial Pilot Leases to Accelerate Offshore Wind Development

· Advanced Manufacturing Incentives for Renewable Energy Market Growth

Net Metering

Net metering allows residential and commercial customers who generate their own electricity from solar power to feed electricity they do not use back into the grid. Many states have passed net metering laws. In other states, utilities may offer net metering programs voluntarily or as a result of regulatory decisions. Differences between states' legislation and implementation mean that the benefits of net metering can vary widely for solar customers in different areas of the country. GSREIA regularly intervenes in Public Service Commission dockets to ensure the continuance and predictability of healthy net metering policies.

What Is Net Metering?

Net metering is a billing mechanism that credits solar energy system owners for the electricity they add to the grid. For example, if a residential customer has a PV system on the home's rooftop, it may generate more electricity than the home uses during daylight hours. If the home is net-metered, the electricity meter will run backwards to provide a credit against what electricity is consumed at night or other periods where the home's electricity use exceeds the system's output. Customers are only billed for their "net" energy use. On average, only 20-40% of a solar energy system’s output ever goes into the grid. Exported solar electricity serves nearby customers’ loads.

Giving Customers Control Over Their Electricity Bills

Net metering allows utility customers to generate their own electricity cleanly and efficiently. During the day, most solar customers produce more electricity than they consume; net metering allows them to export that power to the grid and reduce their future electric bills. California public agencies and schools will save $2.5 billion in electricity costs over the next 30 years using net metering.

Creating Jobs & Encouraging Private Investment

Net metering provides substantial statewide economic benefits in terms of jobs, income and investment. Net metering increases demand for solar energy systems, which in turn creates jobs for the installers, electricians, and manufacturers who work in the solar supply chain. Today, the solar industry employs more than 250,000 American workers in large part due to strong state net metering policies which have allowed the solar industry to thrive.

Protecting the Electric Grid

Unfortunately, some utilities perceive net metering policies as lost revenue opportunities. In fact, net metering policies create a smoother demand curve for electricity and allow utilities to better manage their peak electricity loads. By encouraging generation near the point of consumption, net metering also reduces the strain on distribution systems and prevents losses in long-distance electricity transmission and distribution.

Be Informed

Check out the SEIA Fact Sheet on Net Metering By Clicking Below:

Renewable Energy Standards

A renewable energy standard (RES) requires utility companies to source a certain amount of the energy they generate or sell from renewable sources such as wind and solar. There are many variants to an RES policy, including clean energy standards (which allow nuclear and low-polluting non-renewable energy sources like natural gas) and renewable goals (which are non-binding). They are sometimes called renewable portfolio standards (RPS).

An RES establishes incremental targets which increase over time; for example, a state could require utilities to increase their renewable generation by 2% each year for the next ten years, resulting in 20% renewable power in that state. The targets, compliance mechanisms, and qualifying resources of RES policies can vary widely from state to state. Some states include more specific requirements (called carve-outs), which further incentivize the deployment of particular market segments or energy technologies.

Creating Competition & Making Clean Energy More Affordable

RES policies are designed to encourage competition between energy project developers to take advantage of the vast renewable energy resources that exist in the United States. Numerous studies have shown that an ambitious RES will help to create thousands of new jobs, spur economic development, reduce pollution, and save consumers money on their utility bills.

According to analyses by the U.S. Department of Energy's Lawrence Berkeley National Lab (LBNL), RES policies do not significantly raise electricity rates, and often result in cost savings for consumers. They also spur local demand for renewable technologies, creating jobs and economic development.

Know the facts

The Ernest Orlando Lawrence Berkely National Laboratory RES Financial Impact Study

Property-Assessed Clean Energy

Property-assessed clean energy (PACE) helps home and business owners finance energy efficiency and renewable energy projects for their property. PACE is a voluntary program in which a home or business owner will receive financing from a local government to cover the up-front cost of qualified energy improvements, and in exchange, will repay the up-front cost through a special assessment on their property tax over a period of years or decades. The financing is secured with a lien on the property. This means that in the event of a foreclosure, the financing must be repaid before other claims against the property. The repayment obligation also remains with the property, so if a solar customer sells their home, the new owners simply take responsibility for the remaining payments as well as ownership of the solar array.

Benefits of PACE Financing

Eligible projects include energy efficiency improvements such as insulation, weather sealing and high-efficiency water heaters as well as solar and other on-site renewable energy systems. PACE spreads the cost of these energy improvements over the lifetime of the project.

PACE has several benefits with respect to solar energy. In some areas, it helps meet the high demand for solar consumer financing. In particular, the long-term financing aspect is crucial to eliminating the up-front cost barrier to solar energy projects. PACE can both increase property values and save consumers money by reducing energy costs.

PACE Programs Have Been a Success

Multiple PACE pilot programs have demonstrated that PACE properties have lower foreclosure rates, increased energy savings and provided other benefits consistent with the initiative's overall policy objectives. Initiated as pilot programs starting in 2008, today 33 states and the District of Columbia have passed PACE-enabling legislation, and 19 states plus DC have operating PACE programs.

Important Fact:

There are authorized

PACE Programs in 33 States.

Credit: PACE Nation

Rebates & Incentives

Effective direct incentives can take a variety of forms depending on the particular situation and administrative abilities of a given state. Some states have chosen to offer tax credits, others to offer up-front rebates administered by state agencies or utilities, and still others offer performance-based incentives that are paid by an agency or utility over time based on kWh production.

Key Principles for Direct Solar Incentive Programs

Set incentives for payback targets - The incentive levels should be set so that solar system owners recoup their system costs over five-years for commercial customers and ten-years for residential customers. With lower installed costs, cheaper financing, and greater tax benefits, commercial systems can be offered lower incentives than residential systems. Incentives can also be tiered by system size. In order to build a significant market, states with very low energy rates or little sunshine sometimes must sometimes offer larger incentives than states with high electricity costs and/or plentiful sunshine.

Encourage efficient systems design - Where possible, incentives should reward high-performing systems. Direct incentives can be adjusted to encourage systems that maximize peak energy production. A performance-based incentive (PBI) is based on the actual energy production of a system. PBIs inherently incentivize optimal system design and encourage active, ongoing maintenance.

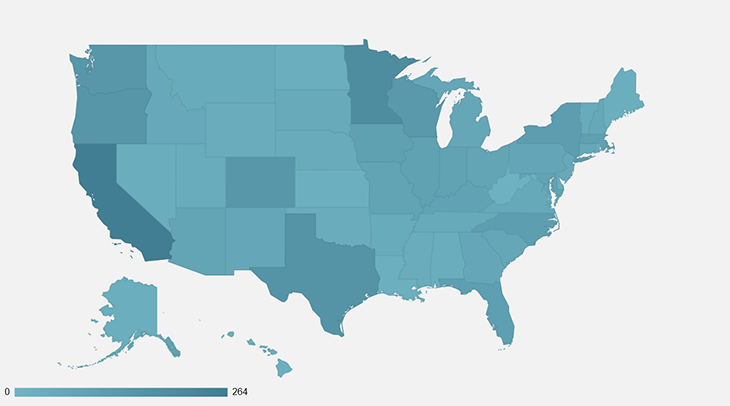

Policies and Incentives

Below is DSIRE's summary maps that provide a geographical overview of financial incentives and regulatory policies that promote renewable energy and energy efficiency in the U.S.

Click the button below to check out the interactive map

Utility Rate Design & Complementary Programs

The operation and regulation of electric utilities is fundamentally different from most other businesses. Almost all other sectors of the economy have free competition, where companies can innovate on products, services, and prices to attract and retain customers and earn profits. Those that succeed can grow, those that fail go out of business. Competitive forces help keep prices in line and prevent companies from acquiring and exercising excess market power.

Utilities are unique in that they are not subject to these competitive forces but are instead granted a state-authorized monopoly over a set of customers in a geographic area. In order to prevent the utility from abusing this monopoly position, state regulators closely control what types of business the utility can conduct, approve the costs that it incurs, and even decide how much revenue and profit it is authorized to collect and earn.

The traditional form of utility regulation is “cost of service” regulation. Under this structure, the utility is authorized to build assets and earn a return of and on their capital. Imagine a utility spends $100 million on a new substation. The “return of” means they will get paid back this $100 million, typically spread over the useful life of the asset. The “return on” means they will earn a profit, typically around 10-11%, on the shareholder equity that was used to build the substation. The utility also is refunded for all normal operating expenses, such as interest payments, salaries, and fuel, as well as collecting additional money to pay for their federal, state, and local taxes. The total amount of money the utility is allowed to collect is called their “revenue requirement”, and this revenue is spread over the total amount of sales to create the rate that individuals and businesses pay for their electricity.

Cost of service regulation contains an obvious and highly problematic flaw. By paying utilities based on how many assets they build, and by charging customers based on how much electricity they sell, utilities have every incentive to build more stuff and sell more electricity. Unfortunately, this “throughput incentive” runs counter to policy goals such as reducing electricity use and increasing access to alternative generation such as distributed PV systems. When faced with technologies and programs that can reduce their earnings, utilities’ responses have often been predictable.

Fortunately, it is possible to design utility revenue policies and rate structures so that utilities and their shareholders are rewarded for working with their customers to encourage conservation and distributed generation of electricity, while at the same time sending price signals that more closely reflect the real-time supply and demand of energy on the grid. The goal is to provide more options for utilities and consumers; no one solution is perfect for every situation.

Revenue Decoupling

Under current regulation, most utilities’ revenue generation is tied directly to retail sales, and therefore any reduction in energy consumption directly reduces the companies’ profitability. This creates a powerful financial disincentive for utilities to support energy efficiency and clean and renewable distributed generation, such as solar.

The purpose of a decoupling mechanism is to remove this disincentive, by eliminating the link between electricity sales and profits. Under decoupling, instead of higher-than-expected sales leading to higher and higher revenues, the utility would only be authorized to recover their pre-approved revenue requirement. A simple system of periodic "true-ups" in base electricity rates would either restore to the utility or give back to customers the dollars that were under- or over-collected as a result of fluctuations in electric consumption and retail sales. This corrects for disparities between revenue requirements approved by utility regulators and the revenue that would have been collected based on the approved rates and actual sales.

Time-of-Use Rates

The cost to generate electricity can vary dramatically at different times of the year and of the day. Hot summer afternoons, when everyone has their air conditioners on high, require utilities to run less efficient, more expensive power plants to meet demand. By contrast, mild spring weekends often have substantial spare capacity, requiring only the most cost-effective generators to meet load. Wholesale power prices can range between $25/MWh in these mild times to more than $1,000/MWh during times of peak demand.

However, most utility customers pay the same price for electricity regardless of when it is used. This is contrary to the basic principles of supply and demand, and as a result, homeowners and businesses have no real incentive to minimize their use of grid-supplied electricity during peak demand hours. Absent a price signal to tell customers to control their usage during specific times, a utility might have to build or buy more generation, transmission, or distribution capacity, which will increase everyone’s costs.

If consumers instead received price signals that more accurately reflected the supply and demand of electricity, they might choose to conserve energy or generate their own. Time of use (TOU) rates send this price signal by charging more during times of peak demand and less during times of low demand. By managing the amount of power that all customers consume on the hottest afternoons, TOU rates can reduce the peak demand and prevent utilities from building costly generation assets that sit idle during non-peak demand hours.

Under most conditions, utilities face very different costs for generating electricity at different times. However, in most places utility customers pay the same price for electricity regardless of when it's purchased. These markets are divorced from the basic principles of supply and demand. As a result, homeowners and businesses have no particular incentive to minimize their use of grid-supplied electricity during peak demand hours. If consumers received price signals that more accurately reflected the supply and demand of electricity, they might choose to conserve energy or generate their own. As the demand for peak energy grows, utilities are forced to build costly generation assets that sit idle during non-peak demand hours. These generation assets impose unnecessary costs on ratepayers.

Performance-Based Ratemaking

While decoupling policies remove the disincentive to support energy efficiency and solar energy, and TOU rates can provide customers price signals to control their usage, these policies may not be enough to actively engage utilities to support and achieve policy goals. Instead, decoupling and rate design should be complemented through Performance-Based Ratemaking (PBR). PBR sets specific targets for metrics such as customer service, energy efficiency, reliability, distribution generation, and others, and create rewards for utilities for achieving environmental targets beyond their mandates.

A well-designed PBR structure does not shift risks from utilities to consumers, but instead shifts the variables that determine utilities’ financial health. Instead of increasing profits by increasing sales or building more assets, utilities should be able to increase profits by improving performance, reliability and service.

GSRIEA supports PBR mechanisms that:

Eliminate the link between utility profits and utility sales

Reward utilities for improving customer service and system reliability

Encourage maximum energy efficiency and solar energy penetration

Are developed in conjunction with a system that sets specific energy efficiency and clean distributed generation targets, and rewards utilities for achieving those targets

Louisiana Public Service Commission

Mississippi Public Service Commission

Solar Power Purchase Agreements

What is a solar power purchase agreement?

A solar power purchase agreement (PPA) is a financial agreement where a developer arranges for the design, permitting, financing and installation of a solar energy system on a customer’s property at little to no cost. The developer sells the power generated to the host customer at a fixed rate that is typically lower than the local utility’s retail rate. This lower electricity price serves to offset the customer’s purchase of electricity from the grid while the developer receives the income from these sales of electricity as well as any tax credits and other incentives generated from the system. PPAs typically range from 10 to 25 years and the developer remains responsible for the operation and maintenance of the system for the duration of the agreement. At the end of the PPA contract term, a customer may be able to extend the PPA, have the developer remove the system or choose to buy the solar energy system from the developer.

Benefits of PPAs to Solar Customers

No or low upfront capital costs: The developer handles the upfront costs of sizing, procuring and installing the solar PV system. Without any upfront investment, the host customer is able to adopt solar and begin saving money as soon as the system becomes operational.

Reduced energy costs: Solar PPAs provide a fixed, predictable cost of electricity for the duration of the agreement and are structured in one of two ways. Under the fixed escalator plan, the price the customer pays rises at a predetermined rate, typically between 2% - 5%. This is often lower than projected utility price increases. The fixed price plan, on the other hand, maintains a constant price throughout the term of the PPA saving the customer more as utility prices rise over time.

Limited risk: The developer is responsible for system performance and operating risk.

Better leverage of available tax credits: Developers are typically better positioned to utilize available tax credits to reduce system costs. For example, municipal hosts and other public entities with no taxable income would not otherwise be able to take advantage of the Section 48 Investment Tax Credit.

Potential increase in property value: A solar PV system has been shown to increase residential property values. The long term nature of these agreements allows PPAs to be transferred with the property and thus provides customers a means to invest in their home at little or no cost.

What States Are Doing

Check out the breakdown by the National Conference of State Legislatures on PPA Policy